Healthier Choices Management Corp. Reports First Quarter 2017 Financial Results

Delivered strong results with an Adjusted EBITDA improvement of 50% year-over-year

Strong gross margin of 51%

Derivative liabilities reduction of $2.6M; a 25% sequential improvement

HOLLYWOOD, FL, May 9, 2017 /PRNewswire/ -- Healthier Choices Management Corp. (OTC Pink: HCMC) today announced its financial results for the three-month period ended March 31, 2017.

First Quarter 2017 Results and Recent Highlights:

- Net sales from continuing operations amounted to approximately $3.6 million, compared to approximately $2.1 million during the same period last year

- Gross profit from continuing operations increased by approximately $640,000, amounting to approximately $1.8 million, compared to approximately $1.2 million for the same period last year.

- Net loss from continuing operations of approximately $1.8 million; a turnaround of approximately $14.4 million from the prior year. This is in large part due to the repurchase of more than 10 million outstanding company warrants.

Jeffrey Holman, Chairman and Chief Executive Officer of Healthier Choices Management Corp., said, “We are pleased with our first quarter results, which reflect growing momentum in the business as we continue with our commitment to improving the fundamentals of our operations. The progress we have made is largely attributable to simplifying our structure and sharpening our focus.”

Mr. Holman continued, “We have been successful in our efforts to strengthen the balance sheet as evidenced by the 25% reduction in our warrant liability. The result of our tender offer earlier in the year was remarkable. Finally, we believe that our efforts to increase the company’s value will start to translate into an increase in shareholder value.”

About Healthier Choices Management Corp.

Healthier Choices Management Corp. is a holding company focused on providing consumers with healthier daily choices with respect to nutrition and other lifestyle alternatives. One segment of our business is our natural and organic grocery operations in Ft. Myers, Florida. The other segment is a U.S. based retailer of vaporizers and e-liquids. Healthier Choices Management Corp. sells direct to consumers via company-owned brick-and-mortar retail locations operating under "Ada's Natural and Organic" and "The Vape Store" brands.

Healthier Choices Management Corp. Inc. (www.healthiercmc.com).

Forward Looking Statements.

This press release contains forward looking statements within the meaning of that term in the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). Additional written or oral forward looking statements may be made by the Company from time to time in filings with the Securities and Exchange Commission or otherwise. Statements contained in this press release that are not historical facts are forward looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, and are based on management's estimates, assumptions and projections and are not guarantees of future performance. The Company assumes no obligation to update these statements. Forward looking statements may include, but are not limited to, projections or estimates of revenue, income or loss, exit costs, cash flow needs and capital expenditures, statements regarding future operations, expansion or restructuring plans, including our recent exit from and winding down of our wholesale distribution operations. In addition, when used in this release, the words "anticipates," "believes," "estimates," "expects," "intends," and "plans" and variations thereof and similar expressions are intended to identify forward looking statements.

Other factors that may affect our future results of operations and financial condition include, but are not limited to, unanticipated developments in any one or more of the following areas, as well as other factors which may be detailed from time to time in our Securities and Exchange Commission filings: risks involved with our business, including possible loss of business and customer dissatisfaction

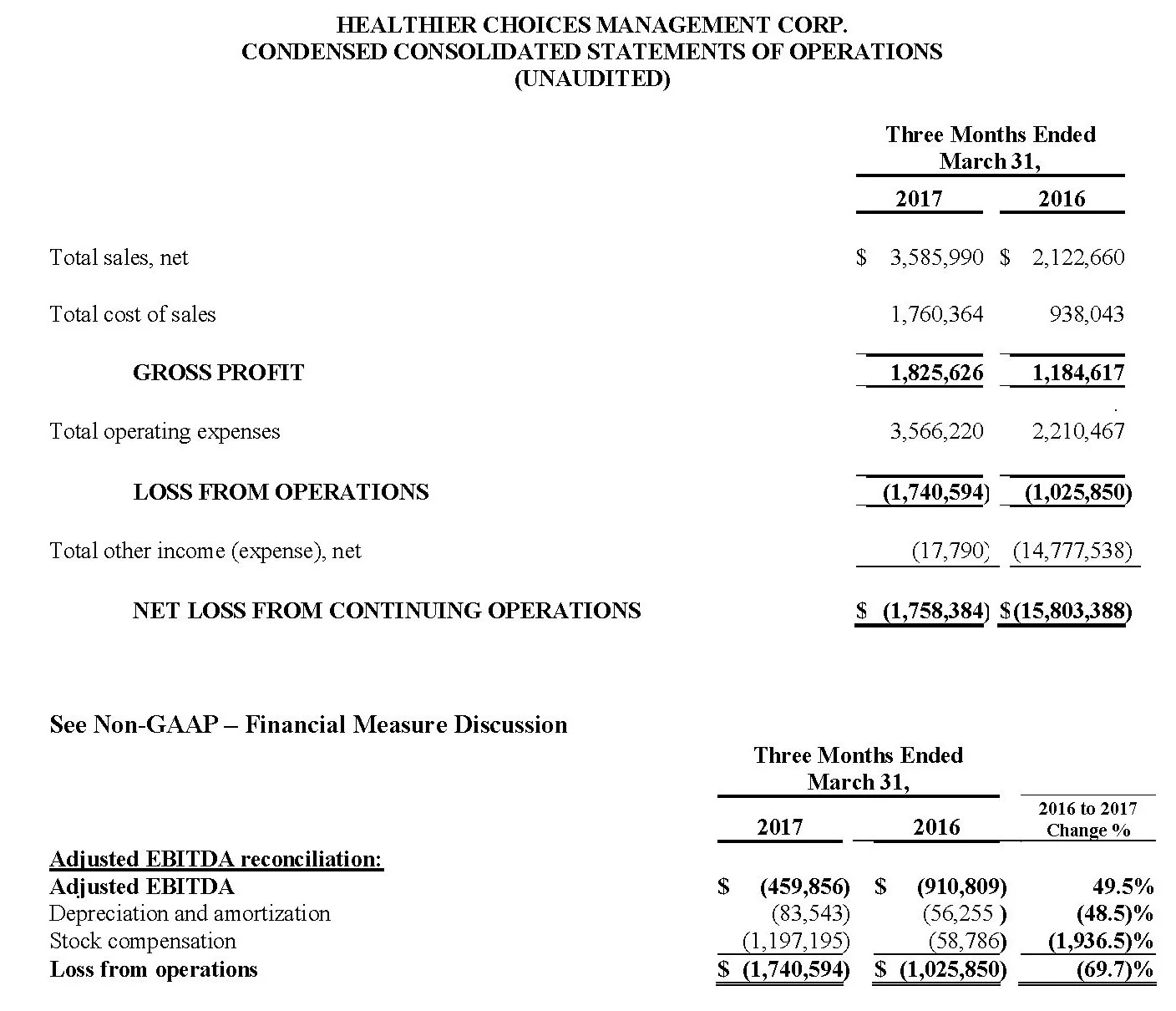

Results of Operations

The following table sets forth our Condensed Consolidated Statements of Continuing Operations for the three-months ended March 31, 2017 and 2016:

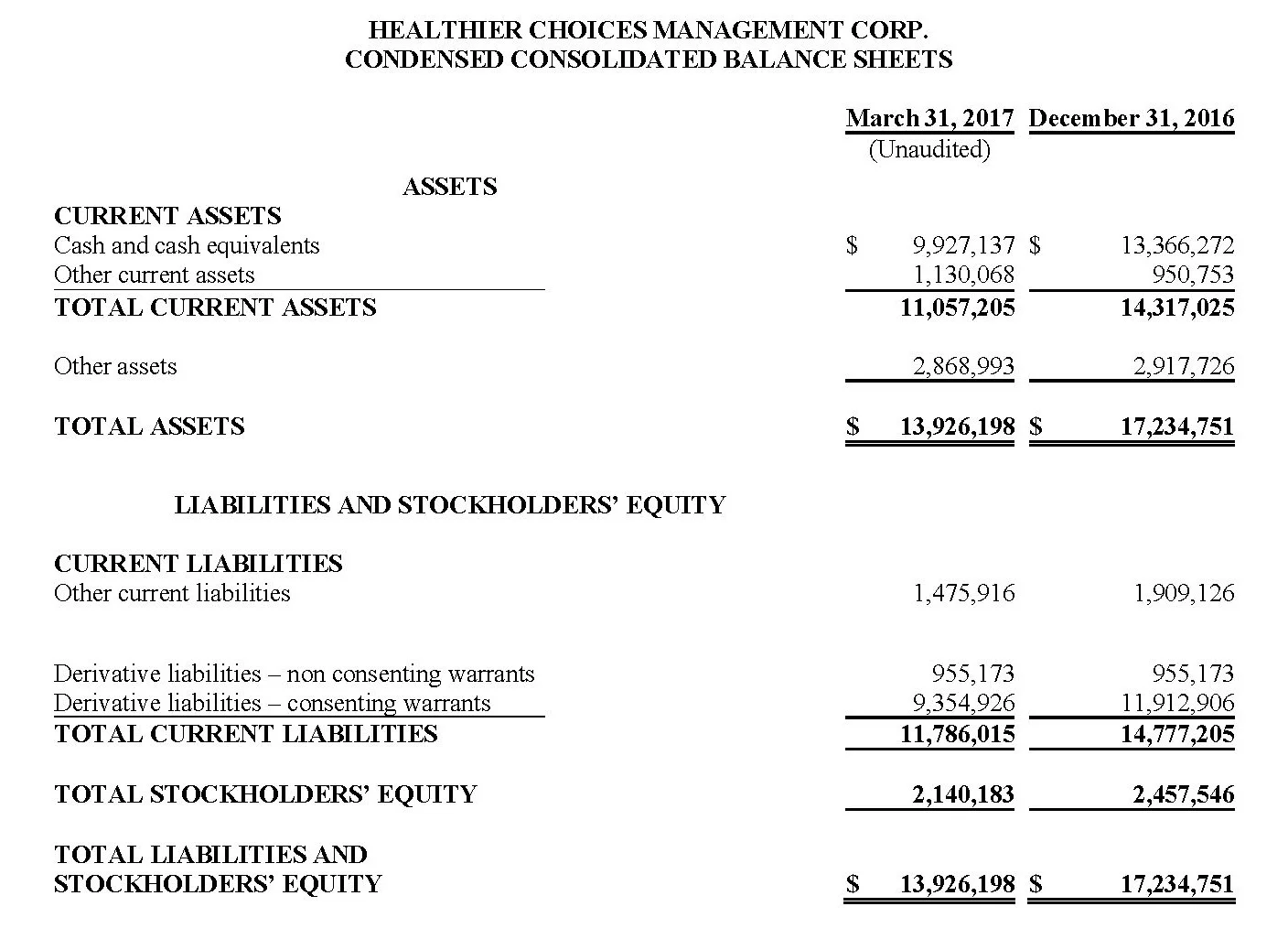

Consolidated Balance Sheets

The following table sets forth our Condensed Consolidated Balance Sheets for the periods ended March 31, 2017 and December 31, 2016:

Non-GAAP – Financial Measure

The following discussion and analysis contains a non-GAAP financial measure. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles (GAAP). Non-GAAP financial measures should be viewed as supplemental to, and should not be considered as alternative to, net income, operating income, and cash flow from operating activities, liquidity or any other financial measures. Non-GAAP financial measures may not be indicative of the historical operating results of the Company nor are they intended to be predictive of potential future financial results. Investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP.

Management believes stockholders benefit from referring to the Adjusted EBITDA in planning, forecasting, and analyzing future periods. Management uses this non-GAAP financial measure in evaluating its financial and operational decision making and as a means of evaluating period to period comparison.

We define Adjusted EBITDA as net loss from operations adjusted for non-cash charges from depreciation and amortization and stock compensation. Management believes Adjusted EBITDA is an important measure of our operating performance because it allows management, investor and analysts to evaluate and assess our core operating results from period to period after removing the impact of significant non-cash charges that effect comparability between reporting periods. Our management recognizes that Adjusted EBITDA has inherent limitations because of the excluded items.

We have included a reconciliation of our non-GAAP financial measure to loss from operations as calculated in accordance with GAAP. We believe that providing the non-GAAP financial measure, together with the reconciliation to GAAP, helps investors make comparisons between the Company and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to specific definition being used and to the reconciliation between such measures and the corresponding GAAP measure provided by each company under applicable rules of the Securities and Exchange Commission (“SEC”).